-

1. Corporate Financing

-

1. ECA Financing (Machinery/Industrial)

An Export Credit Agency (ECA) offers trade finance and other services to facilitate domestic companies' international exports. Most countries have ECAs that provide loans, loan guarantees, and insurance to help eliminate the uncertainty of exporting to other countries.

We have credentials and longstanding relationships with many of the major ECAs and with select Multilateral Finance Institutions (MFIs), which also operate to provide risk mitigation. We can provide our expertise to clients when structuring innovative financing solutions. Working alongside exporters and ECAs or MFIs, we can structure financings that mitigate exposure to so–called political risks, thereby facilitating exports to a potentially greater range of countries.

We acquire a fundamental understanding of the way you do business so we can offer advice tailored to your specific situation. With the use of technology and a powerful global network, we assure our clients with fast and timely access to capital while reinforcing security and enhancing clients’ global experience.

We are here to support you in every step of the way whether you are seeking to:- • Conquer new markets.

- • Secure export or import trade transactions.

- • Pre-finance your export transactions.

- • Improve your Working Capital Requirements.

- • Export Credit Agency Backed Transactions/ECA financing

- • Syndications

We help you find the eminent opportunity around your market and put you in a profit-making position. Our priority is to minimize the cost incurred. We help you benefit from your exports without compromising with much of the profit margin.

Providing services with short-term, mid-term, or long-term needs of the client while following all the legal international regulations

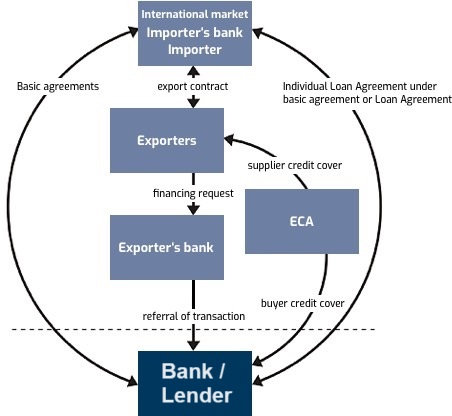

The basics of ECA-covered financeThe basic requirement for financing is the existence of an export contract, which the exporter signs with the importer and which may include services as well. Furthermore, the importer and exporter agree that part of the contract value is to be financed.

Preferably, during the bidding phase to request an offer for export finance. If the transaction meets all the conditions for ECA-covered finance, Mayaseer will then submit a non-binding indicative offer of finance, thus frequently widening the contributing bank’s scope.

EXPORT CREDIT FINANCING - BASIC TERMS & PREREQUISITES- • Imports (goods, machinery and/or services) from Europe is necessary.

- • An Europeran contractor is preferred for the overall project - speeds up the process. We can support to tie up with a renowned contractor & also helps negotiate terms.

- • For an overall import of X Million Euros, a financing of up to 2X Million Euros can be secured at a very competitive rate.

-

2. Bank Financing

Bank financing means asking a financial institution (Bank) to lend money with a promise to repay that money and some additional fee, or interest, over a period of time. Access to financing is critical to every growing business. And when business opportunities arise, you need quick access to funding.

We can provide you with the following services:- • Identification of potential sources of financing

- • Preparation of suitable documentation

- • Promote the transaction to prospective lenders and secure competitive bids

- • Negotiations with banks

- • Verification of conditions and loan agreements

Our network and expertise around different markets will help financing become approachable even with currency differences. We help with all the proceedings and legal work on your behalf while having total transparency of the negotiation. Bank financing involves a huge deal of time for all the legal proceedings. We want you to help share the burden, as we want you to primarily focus on the product.

-

3. Project Financing

Project finance refers to the funding of long-term projects, such as public infrastructure or services, industrial projects, and others through a specific financial structure. The cash flows from the project enable servicing of the debt and repayment of debt and equity.

Mayaseer has helped structure project financing for industrial and infrastructure initiatives throughout North America, Africa, Asia, Middle East. We have a multi-lingual team in 5 offices, working together to apply sharp industry expertise and project experience that meets time-sensitive demands.

We simplify and streamline the complex finance clearing problems for our honored clients. Our project finance services are comprehensive, flexible, and can be modified as the client’s needs evolve. We help our clients to find the perfect project finance solutions with a long-term perspective.

Project financing calls for knowledge of the unique banking, industry and regional considerations affecting a project, and structure terms that take account of such considerations.

Our project finance services include:- • Advisory Services

- • Preparation of detailed project report.

- • Negotiation and liaising with financial institutions & banks.

- • Due Diligence

- • Working Capital Finance

- • Term Loan

- • Assisting in obtaining finance from Bank

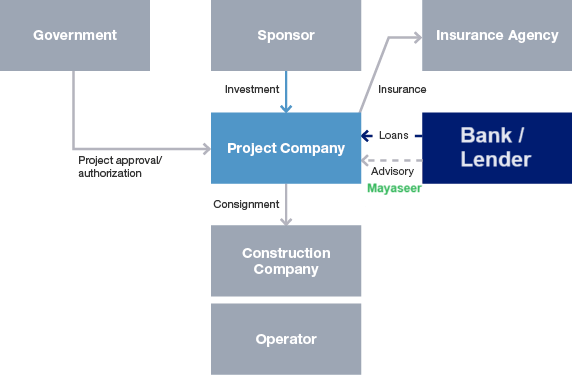

Structure of a Typical Project Financing Arrangement

- 1. The sponsor establishes and invests capital in the project company, which will serve as the borrower.

- 2. The project company signs contracts with various parties involved in the project.

- 3. The project company signs a loan agreement with the financial institutions and borrows funds for the completion and operation of the project.

- 4. The project company uses cash flows that are generated from the project to repay the loan.

In project financing, the lenders have limited recourse. Due to this, the risk is higher for lenders because until the commencement of the project there is almost no return. In the supply shortage of lenders, with our exposure to different investors and markets, we make it easier for you to find an investor.

As the return is paid entirely from project cash flow, we ensure there are no hindrances while securing the capital.

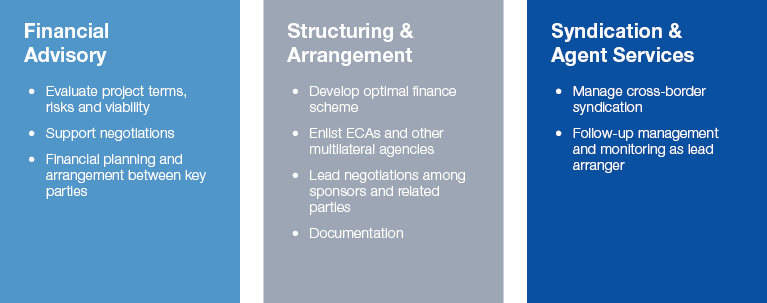

Mayaseer’s Roles at Each Stage of Project Finance

Industry Sectors Covered- • Life sciences / Pharmaceutics / Biotech

- • Industrial

- • PPP (Public Private Partnerships)

- • Power Generation, Transmission, and Distribution

- • Real Estate

- • Energy / Renewal Energy

- • Healthcare

- • Hospitality, Airline & Tourism

- • Industrial

- • FMCG & Retail

- • Technology

- • Infrastructure

- • Luxury Goods

- • Waste Treatment

- • Telecommunications, Information Technology

-

4. Real Estate Financing

Real estate financing describes several financial methods used by potential investors for securing their independent capital investment. It is a long-term transaction involving huge capital with less liquidity.

Real estate projects take up a lot of money upfront, we can help you to access funds across the capital stack right from early-stage equity to late-stage debt covering mezzanine & structured debt, construction finance, lease rental discounting, loan against property, etc.

The Services that our firm provide include the following but are not limited to- • Building a financial model to get the financing.

- • Valuation for strategic deals

- • Competitors Analysis and market prospective study

- • Investor Presentation Deck

- • Due Diligence

- • Deal Support for the entire life cycle of investment

Buying a property is not an easy task, and is definitely a costly affair, we help with minimizing the cost by finding the best deal for your business and needs. While it is a difficult task, we stand beside you to help you throughout the process.

Addressing Other Business NeedsThe securitization financial model helps real estate owners diversify financing methods and optimize their balance sheet.

For those who need to consolidate or relocate their business centres, we provide simulations and cost estimates involved in such an action and suggest plans for effective alternatives. We also advise and provide optimal solutions for any real estate–related issues that may arise in the course of business development.

-

5. Bridge Financing

Bridge financing, often in the form of a bridge loan, is an interim financing option used by companies and other entities to solidify their short-term position until a long-term financing option can be arranged. Bridge financing normally comes from an investment bank or venture capital firm in the form of a loan or equity investment.

Bridge financing is also used for initial public offerings (IPO) or may include an equity-for-capital exchange instead of a loan.

We help our clients to obtain Bridge finance which can be suitable for individuals and businesses that need a short-term financial solution to meet their capital needs. This kind of loan can allow firms or people to take advantage of opportunities that arise that they may otherwise have to turn down. Bridge financing options include debt, equity, and IPO bridge financing.

We offer bridge financing for the following solutions, but not limited to :- • Business obligations

- • Cash flow cover

- • Securing a property

- • Unmortgage able properties

- • Auctions

- • Renovations

- • Finance a new startup or business

- • Refinance other loans

Bridge financing can be a tedious task even if you are in the market. We help our clients to get the capital with the minimum cost involved. It is usually taken for the short-term needs for capital. We ensure you don’t lose any potential gain due to a lack of funds.

We provide services for all the available bridge financing sources i.e. Debt Bridge financing, Equity Bridge financing, and IPO Bridge financing

-

6. Receivables Financing

Receivables financing is when a business receives funding based on issued invoices. This is usually opted by businesses to have a steady cash flow in the business.

We understand that there might be several situations where our clients need Receivables financing. We strive to find the right financing partners to achieve the most economically attractive and flexible structure, consistent with market conditions and management objectives.

Our scope of services includes the following:- • Designing and formulating the strategy

- • Providing insightful market analysis

- • Coordinating other advisers (e.g. lawyers, transaction support providers)

- • Proposing the financial and commercial structure of the transaction

- • Due Diligence

- • Negotiating

Accounts receivable financing allows companies to get instant access to cash without jumping through hoops or dealing with long waits associated with getting a business loan. It may be a good alternative for your venture.

We help you throughout the deal and advise you on the best option. Our team of experts analyses your finances to provide specific solutions to your problems.

We draw on the expertise of colleagues who can advise clients on the unique industry, regional, securities, environmental, construction, tax and joint venture considerations that are often involved in project finance. If necessary, we help clients resolve disputes through litigation, mediation, or arbitration.

We work with lenders, sponsors, investors, and suppliers in the public and private sectors in GCC, LEVANT (Middle East), Africa, Asia and South America

-

-

2. Syndicated Finance

We have a solid reputation in the syndicated loan market, leveraging our global network and large pool of investors to distribute debt in both the primary and secondary markets.

Structure of a Typical Syndicated Finance

- As an arranger, we negotiate terms and conditions with clients and secure syndicate lenders.

- As an agent, we oversee an array of administrative tasks, including processing loan applications, assigning loan portions, and disbursing principal and interest payments to other syndicate lenders on behalf of the customer.

Benefits of Syndicated Loans